Novel seismic and electromagnetic techniques are helping energy companies find new sources of oil and gas

In 1924 geologist Ludger Mintrop predicted that the rock beneath a patch of land in Orchard, Texas, should contain a geological feature known as a salt dome – a block of salt that often traps hydrocarbons. The prediction was significant because Mintrop made it by sending sound waves into the Earth and recording the reflections – the first time that anyone had ever tried to use sound to look for reserves of oil or gas. He was vindicated through subsequent drilling, and the basis of his technique is still used by energy companies to find new reserves of oil and gas without first having to drill expensive holes in the ground.

However, energy companies need to develop better exploratory techniques if they are to exploit existing reservoirs to the full and find new sources of oil and gas. There is still plenty of oil left in the ground, with the industry meeting the current demand of 29 billion barrels per year. But production from existing fields is in decline and the volume of newly discovered reserves peaked in the year 2000.

Some of the increase in global energy demand that is predicted to take place over the next few decades will probably be met by new and existing forms of renewable energy and, perhaps, by nuclear energy. But not all of it. Much must continue to be satisfied through oil, gas and other fossil fuels. To guarantee this supply, the energy industry must make seismic exploration more efficient and develop other exploratory probes, such as low-frequency electromagnetic signals.

Sounding out reserves

Today’s oil and gas reserves formed over millions of years, after dead micro-organisms settled on the seabed and were then compacted by subsequent layers of sand and silt. The resulting high temperatures and pressures broke the organisms into their constituent hydrocarbons, which rose up through the “matrix” of sedimentary rocks back towards the surface. These hydrocarbons then accumulated along faults in the Earth’s layers or beneath traps such as salt domes.

Detecting these reserves involves generating a sound wave from points on the surface (or close to the surface) and then recording the multiple reflections that occur as the wave bounces off boundaries between different types of rock beneath the surface. Assuming that the velocity of sound below ground can be determined, the time of arrival of each reflected wave provides a measure of the depth of the respective boundary, and the amplitude of the wave gives some indication of the changing subsurface rock type. Together, these two types of data can generate an image of the Earth’s subsurface that shows the location of faults and traps, and therefore of potential hydrocarbon supplies.

Although this seismic technique is simple in principle, in practice it poses a number of major problems. These arise in part from the sheer scale of the exploratory operations, with highly sensitive measurements being carried out over huge areas and over extended periods of time, often in challenging environments. In offshore exploration, for example, a single seismic vessel tows almost 10,000 detectors that are spread over an area of 10 km2 (figure 1), making several billion measurements over the course of a few months. Conducting this experiment in the North Sea, one of the most hostile marine environments known, involves dealing with force 8 gales and 15 m high waves. On land, the challenges can be just as difficult. For example, Apache, the oil company that I work for, recently evaluated 1000 km2 of desert in Egypt using nearly three million individual detectors and enough connecting cable to circle the Earth twice.

A major challenge is the need to generate sound waves that are strong enough to be detected after they have been reflected from subtle changes in rock characteristics up to 8 km below the Earth’s surface. While explosives are still used in some onshore experiments, most companies tend to use hydraulics to shake a large mass in a controlled way, generating a broad spectrum of frequencies that can propagate through the Earth (figure 2). Offshore, explosives have long since given way to environmentally friendly compressed-air guns that generate high-pressure “pops” in the water.

Another major challenge is to ensure that the detectors are sensitive enough to register the extremely low-energy reflected sound waves. Offshore, hydrophones are used. These devices are usually built from piezoelectric materials, which generate a current when subject to mechanical strain. Each hydrophone is capable of detecting pressure changes equivalent to changing the depth of water by less than the thickness of a piece of paper.

Onshore, the traditional detector of choice is the coiled geophone, in which a magnet inside a coil moves in response to the sound vibrations and generates a current in the coil. Recently, however, companies have started to use sensors based on microelectromechanical systems (MEMS) to make measurements on land, as well as on the ocean floor. At the heart of a MEMS geophone lies a small piece of a silicon chip that moves with respect to the silicon slice from which the chip has been etched. Such a sensor is considerably smaller and therefore lighter than a traditional geophone, which is a significant benefit when thousands of such devices have to be moved around during the course of an exploration. In addition, the frequency response of these MEMS devices is essentially flat for all the frequencies that are of interest in seismic exploration.

The other significant challenge in oil and gas exploration is the huge amount of data processing involved. Indeed, the seismic exploration industry has become one of the biggest users of computing capacity in the world, only just behind the military and the weather-prediction industry. It is interesting to note that the microchip manufacturer Texas Instruments was originally formed as a subsidiary to a seismic company – Geophysical Services International – to provide instruments in support of geophysical data acquisition and processing. As data-processing technology becomes more sophisticated, this stage of work can take several months, despite massive computing capability.

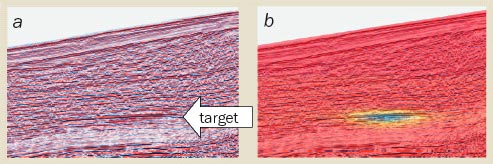

Interpreting all of these data has led to the development of 3D imaging techniques specific to the oil and gas industries. It is not unusual to hear geophysicists in oil companies talk about “immersion” in virtual-reality simulations of subsurface geology (figure 3). These simulations can, for example, allow researchers to plot the optimum course of a well through the Earth, a complex task because of the great number and variety of features in the rock. The course of a well often has to travel horizontally as well as vertically, and sometimes even has to travel back towards the surface before reaching the intended target, which is often many kilometres from where the well meets the surface.

Maximizing results

Traditional basic seismic techniques have only been used to identify subsurface structures that may contain oil (or gas), but they cannot tell researchers whether or not oil is definitely present. That is because the reflected waves convey only limited information. For instance the amplitude of the waves cannot tell you directly about the absolute density of the rock from which they have been reflected but only about how the product of rock density and wave speed changes across each rock boundary.

As a result, companies must drill a hole if they are to be sure of having found oil. Often these holes turn out to be “dry”, which is unfortunate given the huge amounts of money involved. The cost of drilling a deep-water well can often exceed $50m, since drilling rigs are expensive to build and maintain, and it can take months or even years to drill a well. In areas where there are no existing oil wells, the success rate for such drilling may be below 50%, so any information that can reduce the risk of failure is welcome. However, as technology has advanced, geophysicists have been able to deploy greater numbers of detectors and therefore generate ever-sharper images. With seismic sources and detectors spread out over a surface, researchers can now examine the same point in the Earth using sound waves that have been reflected over a range of angles. This allows them to calculate, among other things, the position of the reflecting surface with much greater accuracy and therefore target their wells more effectively.

As well as locating oil and gas reserves in the first place, energy companies are also now using seismic data to monitor how the distribution of hydrocarbons varies within a reserve over time. This allows them to optimize the production of subsequent wells so that they can extract the last drop of oil from the underlying reservoir. Recently BP deployed a permanent seismic experiment on the floor of the North Sea around the Valhall field, from which it will obtain data every few months. Such repeated experiments are often referred to as “4D seismic”, in contrast to the static 3D image that is usually obtained. Until recently 4D was used mainly by major oil companies, but it is now also being exploited by smaller independent firms.

Another recent improvement to the traditional seismic technique has been to measure the shear or “S” waves produced when a sound wave bounces off a surface. These are transverse waves that result from vibrations of atoms in the rock that are at right angles to the direction of wave propagation. Such waves are generated in addition to what we normally think of as sound waves – the compressional or “P” waves generated by atoms vibrating along the direction of wave propagation. The two types of wave behave differently in fluid, which means it is sometimes possible to determine the presence of oil and gas by comparing the arrival times and amplitudes of reflected P and S waves.

Exploration companies have long known about the virtues of measuring both P and S sound waves. But doing so requires more than a single sensor on the surface, which has historically made such seismic experiments more expensive. Today, however, these extra costs have been reduced significantly (on land at least) by using MEMS technology to build the sensors, and in some cases the benefits of the technology may outweigh the small additional expense.

Beyond seismic techniques

While seismic data have been the staple of oil and gas exploration for many years, there are some useful geological properties such as porosity, permeability and density that are impossible to measure directly using sound. Some of these properties can instead be studied by measuring resistivity, because layers of rock saturated with hydrocarbons are often more resistive than the surrounding material. Doing so involves taking a “log”, whereby geophysicists send a tool down the well and make continuous resistivity measurements as the tool is lifted out of the hole. By providing a cross section of the different rock strata, these measurements can pin down the precise location of potential hydrocarbon layers.

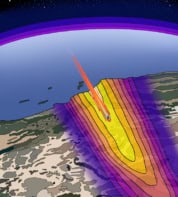

Being able to carry out these measurements without first having to drill a hole would reduce the risk of ending up with dry holes, but developing such non-invasive techniques has proved challenging. One such technique, called marine active source electromagnetic sounding, involves towing a high-energy electric-dipole antenna from a boat and allowing it travel close to the sea floor. The antenna transmits a low-frequency electromagnetic signal – from a few tenths of a hertz to a few hertz – to an array of receivers anchored to the seafloor. By moving the antenna and recording the changing signal at each receiver, researchers can build up a 3D plot of the local electric field. The position of any resistive layers below the sea floor, which could potentially be layers of hydrocarbons, can then be estimated from the effect that these layers have on the shape of the field (see figure 4).

This technique has been used for over 20 years by academics to study geological features such as mid-ocean ridges, but it has not been used extensively by the energy industry. This is partly because the approach has been limited to deep waters. Since the air above the water also acts as a resistive layer, its presence will interfere with the measurements of subsurface geology if the surface of the water is relatively close to the seabed. However, research is being carried out in both universities and industry that could extend the technique to shallow waters. This research includes trying to measure the interfering signal from the surface, and studying the effects of changing the frequency of the transmitted signal.

Research is also being carried out to extend the technique for use on land. In particular, Anton Ziolkowski and colleagues at Edinburgh University have developed a technique that involves placing an antenna on or close to the Earth’s surface and measuring the signal at several points on the surface. However, this is currently time-consuming, because the antenna and detectors need to be moved between each set of measurements.

In addition to improving the electromagnetic techniques themselves, the energy industry is also trying to simplify the analyses of the data collected from these techniques. Such data are currently interpreted using a combination of forward modelling – building a model of the Earth and then calculating how this model should respond to electromagnetic signals – and geophysical inversion – which involves trying to determine the resistivity of the Earth directly from the data collected. Although these techniques can provide accurate measurements of resistivity below the sea floor, the huge computational power needed for geophysical inversion limits the speed of data interpretation. The industry is now working towards faster imaging techniques using sophisticated computational routines that have become familiar in seismic data processing over the last few decades.

A collective approach

The oil and gas industry is unusual in being able to transform scientific data into a successful “bottom line” with great speed. From the initial decision to explore in a new area, it is sometimes possible to acquire seismic data, process the data, interpret the results and subsequently drill a well in a matter of months. The commercial utility of these data has meant that energy companies have historically developed many physics-based technologies themselves. But in the last few decades, hydrocarbon exploration has become an industry in itself, and energy companies have slowly divested themselves of their development groups.

Most fundamental geophysical research and development is now performed within exploration service companies – such as the multinationals Schlumberger and Haliburton, as well as in many smaller firms – or in universities. Often exploration companies will work together with academic groups in large collaborations sponsored by the oil and gas producers. These collaborations are likely to become more widespread as technology becomes ever-more critical to the health of the oil and gas industries. Without such technology, the world will struggle to satisfy its rapidly increasing appetite for energy.

Further reading

J Brum 2005 Realizing the value of visualization centers E&P January pp40-49

S E Johansen et al. 2005 Subsurface hydrocarbons detected by electromagnetic sounding First Break March pp31-36

P Kearey 2002 An Introduction to Geophysical Exploration (Oxford, Blackwell)

P Roberts 2004 The End of Oil: On the Edge of a Perilous New World (Boston, Houghton Mifflin) M J Tompkins 2004 Marine controlled source electromagnetic imaging for hydrocarbon exploration: interpreting subsurface electrical properties First Break August pp45-51

D Yergin 1993 The Prize: The Epic Quest for Oil, Money and Power (New York, Simon and Schuster)