Margaret Harris looks back at some of the companies that advertised in the first issue of Physics World – and finds out how the industrial physics community has (and has not) changed

In October 1988 Anthony O’Dowd was working as a physicist at CERN, developing hardware for the OPAL experiment on the Large Electron-Positron Collider. Two years later, he joined IBM’s offices in Hursley Park, UK, expecting to do similar work on the device drivers that link hardware to computer operating systems. But on his first day at IBM, O’Dowd discovered that there had been a slight change of plan. “I was going to work on this new thing called ‘software’,” he recalls.

In that same month, another physicist, Paul Gosling, was employed at a now-defunct telecommunications firm called STC Technologies. At first he specialized in radar signal processing, but after two years he changed jobs, moving to work on sonar at what was then Ferranti-Thomson. “It was Ferranti first, then Ferranti-Thomson and [then] Thomson-Marconi,” he says, ticking off the names of his employer’s various incarnations with well-practised ease. “Then various other companies came in and we merged with Racal to become Thales.”

The summer of 1988 also saw the start of Angelo Amorelli’s post-PhD career. By October that year, just as Physics World was starting, the Cambridge-trained chemist had a job in the refining group at BP’s research centre in Sunbury, UK, where thousands of scientists and engineers worked on everything from solar panels to food science. “It had quite a scientific feel to it,” he says. “Like a university chemistry department. It was an easy transition.”

Graham Batey had made a similar switch a few years before, joining Oxford Instruments in 1985 after using one of the company’s dilution refrigerators during his PhD. “That was my foot in the door,” he says, adding that his first job involved designing dilution refrigerators for customers who, like him, were mostly interested in fundamental physics research.

O’Dowd, Gosling, Amorelli and Batey have a lot in common. Despite spending all or most of their careers with the same employer, they have seen substantial changes in their respective industries. They have also risen to senior positions: O’Dowd is a distinguished engineer and solution architect for blockchain at IBM; Gosling is vice-president for engineering at Thales; Amorelli is head of group research at BP; and Batey is chief engineer for ultralow temperature at Oxford Instruments Nanoscience. And as it happens, their employers have something in common, too. BP, IBM, Oxford Instruments and three of Thales’ predecessors were all among Physics World’s first advertisers, hawking their services, products or job vacancies alongside two dozen other firms in the magazine’s inaugural October 1988 issue.

These 30 companies make up a cross-section of the industrial-physics community as it was three decades ago. The list is notably varied, with both giant multinationals and small outfits represented in the magazine. Ads for consultancies appeared in the same pages as ads for laser specialists and manufacturers of vacuum equipment, and there were no fewer than seven different companies with the word “instruments” in their names. There were also a few wildcard advertisers, including an insurance agency, a hotel and – plus ça change – a campaign to “Save British Science”.

Physics-based firms that advertised in that issue are, of course, merely a sample of the range of hi-tech businesses from 30 years ago. Many major players (including several that went on to advertise with the magazine later) are absent from it. Even so, the varied fortunes of this disparate bunch of companies reveal a lot about how the landscape of industrial physics has changed – as well as a few ways it hasn’t.

Closure and consolidation

Let’s start with the bad news. Of the 30 advertisers with physics at the core of their business (a definition that excludes the wildcards and a handful of scientific publishers), two – Cryophysics Ltd and Lucas CEL Instruments – filed their last accounts sometime around the year 2000 and no longer exist. A third, Alliant Computer Systems, was mentioned prominently in an October 1988 ad for an upcoming conference, but ran into financial problems soon after and went bankrupt in 1992.

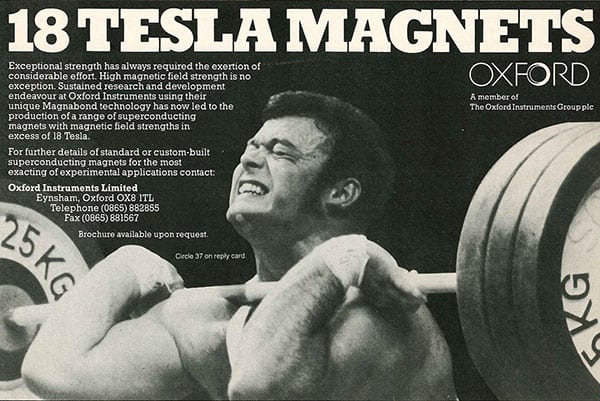

The rest, however, have proven remarkably resilient. Amazingly, Oxford Instruments even sells the same 18 T magnet that appeared in its advert (above), although Batey is quick to point out that the device is “smaller now” and has extra features such as a pulse-tube refrigerator and a recondenser for boil-off gas. Other survivors include VAT Vacuum, a Switzerland-based valve manufacturer; and Thales’ defence-sector rival BAE Systems, which was known as British Aerospace until it bought Marconi Electronic Systems in 1999. All told, 11 companies out of the original 30 still exist in a form that observers from 30 years ago would recognize.

As for the remaining 17 – well, this is where it gets complicated. A handful were bought out by employees and now operate as similar businesses under different names. Zenon Palacz joined one such firm, VG Isotopes, in July 1988, and is now managing director at a successor called Isotopx. Despite a complicated series of buyouts, mergers and de-mergers – a journey that Palacz summarizes as “quite a ride” – the company continues to sell thermal ionization mass spectrometers and other scientific instruments from its base in Cheshire, UK.

For the most part, though, companies in this 17-strong group have been bought by larger organizations and then more or less been absorbed into them. This category includes three firms – Pilkington Electro Optic Materials, Racal Services and Rediffusion Simulation – that became part of Thales. Asked about the consolidations, Gosling says simply that there were “too many players in the market”, adding that the boundaries between defence and civil technologies have blurred. “Some of these businesses that were predominantly defence businesses have diversified,” he explains. “If you look at things like autonomous cars, for example, that’s a civil application, but we know there’s also a lot of interest in maritime autonomy for mine-sweeping.” This blurring process isn’t new: in 1991, nine years before the merger that created Thales, another part of Racal was split off to become the mobile-phone giant Vodafone.

Same name, new look

The defence sector is not the only one to have experienced extensive consolidation and diversification. Amorelli notes that BP, like many other oil and gas majors, underwent a period of diversification in the late 1980s “because oil was meant to run out by the mid-1990s”. When that didn’t happen, the company shed several of its peripheral operations – including its food business, BP Nutrition – to focus on its core. Then, in the late 1990s, falling oil prices triggered a series of mega-mergers with Amoco, Arco, Castrol and others. According to Amorelli, that produced major shifts in both the company’s overall structure and its activities at Sunbury. “One of the things that has changed significantly for BP is globalization of our activities,” he says. “We ended up with a portfolio of research centres.” As a result, the diverse, university-like centre he joined in 1988 is now “more of a business park with some technology and engineering embedded”.

We recognize that we can’t do everything, and I think that’s a big change from 30 years ago

Other shifts have also left their mark on the Sunbury centre. “We recognize that we can’t do everything, and I think that’s a big change from 30 years ago,” Amorelli says. “Companies traditionally would do almost all their research and development internally. Now we do a certain amount, but we are quite happy to work with third parties that have complimentary capabilities.”

BP’s involvement in solar and wind energy is one example of that co-operation. When Amorelli was the company’s head of technology for wind, he says, “people asked me whether we should be investing in the development of wind turbines, but there were so many great companies out there already”. Instead, he explains, “we focused on what we could do, which is investing in projects and bringing clean energy to the market”.

Similarly, BP no longer employs physicists to work on semiconductor technologies for solar panels – the subject of its recruitment advert in the first issue of Physics World. Instead, it recently invested $200m in partnering with an experienced firm, Lightsource, which develops solar-power assets in Europe and beyond. The emergence of a specialized semiconductor industry also influenced BP’s decision to exit solar-panel research. As Amorelli explains, once economies of scale took over semiconductor manufacturing in East Asia, it was no longer profitable elsewhere.

For other companies in Physics World’s original group of advertisers, however, this same trend led to fresh opportunities. When Kurt Sonderegger started working in VAT Vacuum’s all-metal valve business in 1990, “researchers were our main customers – there were only little industrial applications on the side”, he recalls. Then the company started getting queries from semiconductor manufacturers, and its focus began to shift. Today, Sonderegger’s colleague Arno Zindel, a member of VAT’s board, calls research customers “the deepest root that VAT has”. In terms of sales volume, though, their main clients are manufacturers of semiconductors, flat-screen displays and – yes – solar panels.

The computer says go

The biggest changes to industrial physics stem from the rise of computing and the Internet. “Thirty years ago, we had two computers here at VAT,” Sonderegger says, a note of wonder creeping into his voice. “We used them for the stock-keeping of parts.” At BP, says Amorelli, “I can remember telexing refineries to give them advice, and that advice was in response to a sample that had taken three weeks to get to us. Now a courier like DHL will deliver that sample in a day or two, you can analyse it much more quickly with automated samplers and then we can e-mail the result within hours.”

Batey, of Oxford Instruments, agrees that better automation, coupled with the rise of “dry” or cryogen-free technologies, has made his company’s products much easier to use than they were 30 years ago. “We’ve got computers now that can open up all the right valves automatically,” he says. “Users can focus on their experiment rather than spending two or three days getting the system cold enough – they can just press a button and come back later and it’s ready.”

For IBM, the impact of the computing and Internet revolutions has been even more profound. The new thing called “software” that O’Dowd started working on in 1990 is now “absolutely everywhere and touches every business process”, he says. The rise in the amounts of data handled by that software has also been tremendous. Just ask Peter Waggett, who is IBM’s director of emerging technologies, having joined the company in 1997 when it acquired his then-employer, Data Sciences Ltd. Before that, as an astrophysics PhD student at University College London in 1984, he had a part-time job (“basically beer money”) backing up the physics department’s computer system. “I used to put the whole department on two 12-inch tapes,” Waggett recalls. “Everybody did all their research on that system.”

These days, O’Dowd observes, all those data would fit onto a device the size of a sugar cube. Meanwhile, the data challenges he faced at CERN in the 1980s have become ubiquitous. “Large datasets were the preserve of scientists in ivory towers,” he says. “Nowadays they are commercially relevant in a way they just weren’t before. Think about social-media feeds, think about retail – it’s just vast.”

The computing revolution also helped transform Thales from what Gosling calls “a very hardware-focused business” to one that is much more about mathematics, algorithms and systems engineering. When he joined its predecessor in the early 1990s, the company designed many of its own computers. “That was core to what we did for sonar because sonar systems need a huge amount of computing power,” he explains. Now, the company tends to buy its computers off-the-shelf. As a consequence of Moore’s law, Gosling says, “We worry less about computer power and more about the sophistication of the mathematical algorithms and the software implementation of those algorithms.”

Increasingly advanced software has wrought more subtle changes, too. “When I first started, you had to write an awful lot of software yourself if you wanted to do any mathematical modelling,” Gosling says. “Today you can do very complex signal-processing tasks with tools that you can buy from the market.” As a result, he says, “We found that our intellect has to be diverted in a different direction. I don’t know quite how to put this, but things that we found difficult 20, 30 years ago are now very much easier because of the tools we use. That means we can focus on much more complex problems that we probably hadn’t even time to think about.” As an example, he cites cybersecurity, which “wasn’t big on the list of things to worry about 30 years ago – it just didn’t exist”.

The next three decades

Asked to peer into their (re-engineered, computerized and Internet-connected) crystal balls, scientists at Physics World’s original advertisers offer a variety of answers. Zindel observes that VAT, which had been family-owned for more than 50 years, was sold to an investment group in 2014 and subsequently entered the stock market. The resulting injection of capital, he says, has enabled the company to grow more rapidly in response to ongoing demand from the semiconductor industry. Gosling, for his part, is concerned about the UK’s supply of scientists and engineers. Unprompted, he adds that Thales and other hi-tech firms need to work harder to improve their diversity. The fact that all the scientists interviewed for this article are male and white reflects both the field as it was 30 years ago and the lack of progress since.

There is, however, plenty to be excited about. Amorelli is enthusiastic about the potential of fuels derived from biological substances such as sugar cane. He also waxes lyrical about the cheap computing power that enables his BP colleagues to produce detailed models of fluid flow and features below the Earth’s surface – tasks that were well beyond their 1980s counterparts. Batey mentions computing, too, but of a different type. Oxford Instruments’ markets, he says, now tilt more towards applied and industrial research than they did 30 years ago, and the recent emergence of quantum computing is a contributing factor.

For O’Dowd, the advent of quantum computers is just the latest in a long line of transformations. “If you’re going to have a career that lasts decades, you’re going to expect loads of different technology waves,” he says. “The PC was just emerging in the mid-1980s, then you had the whole of the Internet come along, web servers, Linux, then artificial intelligence and now neuromorphic computing and blockchain and quantum computing. All this stuff came along.”

As a member of the physics community, O’Dowd feels he has an advantage in dealing with change. “Physicists have some really good coping strategies because they’re fundamentally interested in how things work,” he says. “Rather than seeing new things as, ‘Oh my God, it’s a threat, all new stuff is rubbish’, we have a mindset that says, ‘That’s interesting. What’s going on there? What’s that all about?’ ” Regardless of how big, diverse or sophisticated they become, these are questions that companies in physics-based industries will surely be asking for many years to come.