While theorists have been battling to understand high-temperature superconductivity, industrialists have been developing a wide range of devices that are set to enter a global marketplace that is potentially worth billions of dollars.

Over a dozen years have passed since high-temperature superconductors were discovered amid a rash of over-enthusiastic claims that these materials would immediately revolutionize the power, transport and communications industries. The public perception may be that after years of research and unprecedented industrial investment there still seems to be no theory of high-temperature superconductivity, and no practical applications either. However, the reality is very different. Many aspects of the physics and chemistry of cuprate superconductors are now well understood, while the remaining problems are providing a rich source of new physics (see “The underdoped phase of cuprate superconductors” by Bertram Batlogg and Chandra Varma Physics World February 2000). More importantly, however, a wide range of major industrial applications are set to appear within the next few years.

The lure of high-temperature superconductors is partly psychological. Before one’s very eyes these materials become virtually perfect conductors when plunged into liquid nitrogen at 77 K, and become capable of levitating a magnet.

Superconductivity is the macroscopic evidence of a quantum-mechanical state and, as such, is a tangible entry point to the mysteries of the quantum world. However, it is the remarkable physical properties of superconductors that have driven commercial interest in these materials. Superconductors allow lossless electrical conduction and can carry current densities over 2000 times greater than copper wires. They are also used in a wide range of microwave and electronic devices, and in medical and geological scanners to detect magnetic fields less than a billionth of the size of the Earth’s field.

The key factor that has limited the widespread use of conventional low-temperature superconductors (LTS), such as niobium tin and niobium titanium, is the cost of cooling them to around 4 K with liquid-helium technology. In fact the cost of the LTS wire itself is rather low – it is about 16 times cheaper than copper for every metre capable of carrying 1000 amps.

With the discovery of materials such as mercury barium calcium copper oxide (HgBa2 Ca2 Cu3 O8 ), which is still superconducting at temperatures as high as 134 K, expectations of an immediate technology revolution based on high-temperature superconductors (HTS) were heightened. This was not to be, at least not in the short term. As with any new technology, it typically takes 10-15 years to solve the technical challenges and to reduce costs. In the case of high-temperature superconductors, particularly demanding issues are presented by the microstructure of these materials.

Physical properties and challenges

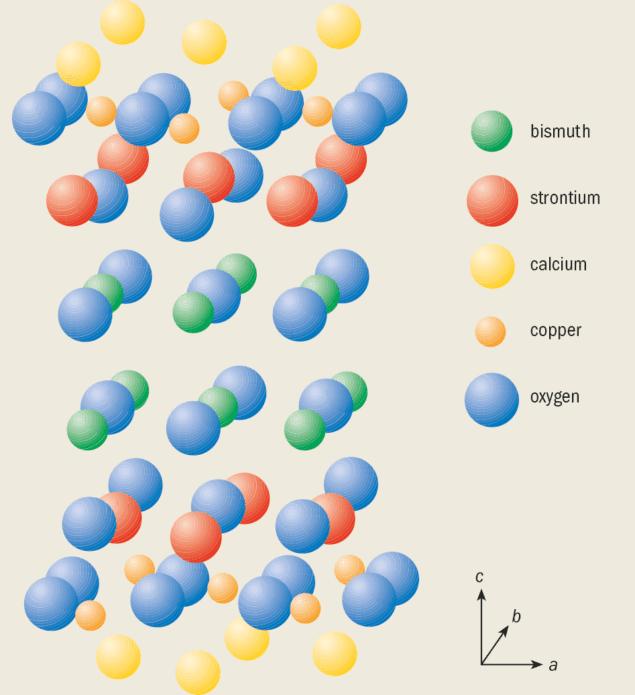

High-temperature superconductors are brittle ceramic materials in which elements such as yttrium and barium, or lanthanum and strontium, are sandwiched between layers of copper and oxygen atoms. This layered atomic structure causes the materials to have highly anisotropic physical and superconducting properties. It is possible to form single crystals, thin films or polycrystalline ceramics from these materials. However, in applications that require long flexible wires, we can only consider two types of wire “architecture”: either thin epitaxial films of HTS material grown on long flexible substrates, or polycrystalline filaments of HTS supported in a metallic wire matrix, which is more realistic to manufacture. When we use granular HTS ceramics, however, we have to ensure that the supercurrents will flow adequately from grain to grain – otherwise the grains are said to be “weak-linked”.

There are two key physical properties related to granular high-temperature superconductors. First, the “coherence length” – the length over which the superconducting wavefunction extends beyond a grain boundary. And second, the “upper critical field” – the maximum magnetic field below which the material remains superconducting. The two properties are inversely related: the longer the coherence length, the lower the upper critical field.

Several issues emerged from early investigations using granular ceramics. High-temperature superconductors have a very high upper critical field (greater than 180 T), which could open up a range of applications in extreme magnetic fields. In turn, however, the high critical field implies that the coherence length is very short, less than 2 nm. This means that the polycrystalline grains tend to be weak-linked unless the grain boundaries are both smooth at the single-atom level and free from disorder over a length scale significantly less than 2 nm.

In addition, high-temperature superconductors are quasi-two-dimensional structures comprising weakly coupled copper-oxide (CuO2 ) layers. They are therefore highly anisotropic. The coherence length in the direction perpendicular to these layers (the c-direction) is shorter still, less than 0.2 nm. This is so small – less than the spacing between some atoms – that the only way to prevent weak links forming between the grains is to align them such that their c-axes are directed perpendicular to the current flow. Grain alignment is referred to as “texturing” and may be accomplished by common metallurgical techniques.

These two factors – the coherence length and the anisotropy – mean that a polycrystalline HTS wire must be dense, have a high degree of grain alignment and have high-quality grain boundaries. Otherwise the critical current – the maximum electrical current that is in the superconductor – would seriously degrade in a weak magnetic field. Even in the absence of an external magnetic field, the critical current in a weak-linked superconductor may suffer from the “self field” generated when current passes through the wire.

Although there are now more than 50 known HTS materials, only two have been used successfully to form long-length HTS wires: the bismuth strontium calcium copper oxides Bi2 Sr2 Ca2 Cu3 O10 , (Bi-2223) and Bi2 Sr2 CaCu2 O8 (Bi-2212). No other HTS system has yet been textured in any practical sense to form long-length wires.

Wire manufacture

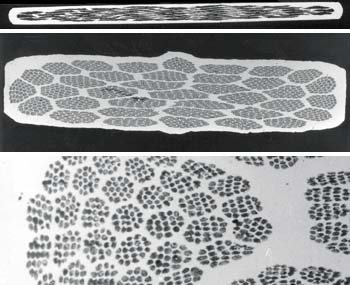

Wires of high-temperature superconductor comprising many filaments of Bi-2223 are typically processed by first packing a “precursor” powder into silver tubes. The precursor powder, containing Bi-2212, reacts to form superconducting Bi-2223 when heated. The loaded silver tubes are extruded and drawn until they reach about 1 mm in diameter. These wires may then be rebundled and drawn several times until the desired number of filaments and wire dimensions are reached. The resulting product is then rolled to a form a flat tape and heat-treated until the compound reacts to form Bi-2223.

During the various deformations, the grains in the Bi-2212 precursor and the resultant Bi-2223 become progressively aligned. The tape may be rolled and heat-treated several times until the grain alignment, density and concentration of Bi-2223 are optimized (figure 1).

A unique advantage of bismuth-based systems is that texturing can be induced by progressively deforming Bi-2212 or Bi-2223. The flexible behaviour of these materials derives from the weak bonding across the double layer of bismuth oxide (see figure 2). As in mica or graphite, this weak bonding provides a “slip system”, which allows deformation-induced texturing – a classic technique in metallurgy. However, this double layer also seriously degrades the intrinsic performance of the bismuth-based superconductors.

The figure of merit of a superconductor is the “critical current density”, Jc , the maximum electrical current that can be supported per unit cross-sectional area of superconductor. However, for a composite wire conductor, which comprises both the superconductor and the silver matrix, a more practical figure of merit is the “engineering critical current density”, Je – this is the critical current per total cross-sectional area of the wire. Clearly Je = fJc where f, the “fill-factor”, reflects the relative ratio of superconductor to silver and may be anything from 15% to 50%. Ideally the fill factor should be as large as possible.

Among the HTS cuprates, bismuth-based systems have by far the lowest Jc in a magnetic field, which limits their use in practical applications. The weakly linked CuO2 layers readily decouple in an applied magnetic field, causing resistive conduction even though the HTS material remains strictly superconducting. This decoupling is governed by the spacing between the CuO2 layers. This spacing is large in Bi-2212 and Bi-2223 because the CO2 layers are separated by a double layer of bismuth oxide. As a result, the sustainable magnetic field for these two materials is two orders of magnitude lower than for yttrium barium copper oxide YBa2 Cu3 O7 (Y-123). Although this does not preclude the use of Bi-2223 in applications, it does mean that this material must be used at intermediate temperatures when large magnetic fields are required. For example, the operating temperature of HTS motors using Bi-2223 wires in 1-3 T magnetic fields is currently confined to below 35 K, even though the superconducting transition temperature of Bi-2223 is as high as 109 K.

The motivation for finding a practical wire technology for Y-123 is therefore obvious. Some hope is held for a coated-conductor technology that uses epitaxial thin films deposited on deformation-textured substrates. Short lengths of these so-called second-generation HTS wires have demonstrated Jc values as high as 10 MA cm-2. Currently the manufacturing process is prohibitively slow as it uses vacuum-deposition techniques. However, very promising results have recently been obtained using a rapid technique whereby the HTS material is deposited from solution.

A further practical issue lies in the cost of producing HTS wire. Silver remains an indispensable, yet expensive, component of Bi-2223 wire technology. Moreover, the processing of these wires is very slow, requiring up to a week for extrusion, drawing, rolling and heat treatment. According to a number of manufacturers, several years ago the cost of HTS wires was around $1500 per kiloamp per metre, divided almost equally between raw materials, mechanical treatment and heat treatment. Recently, however, American Superconductor Corporation announced that the cost of its commercial DC wire had fallen to $300 per kiloamp per metre, and ultimately the company expects to reduce the price to around $50 per kiloamp per metre. In part, such gains are based on the continual increase in Jc of production wires but, more importantly, Je has also steadily increased (figure 3).

In spite of these challenges, enormous progress has been made in developing wire technology and in prototyping a broad range of HTS-based products, to the extent that several companies have now reached commercial levels. Virtually defect-free wires exceeding 100 A per strand at 77 K are now available in lengths of several hundred metres. And wires up to 1 km in length have also been demonstrated. Currently, several companies are rapidly scaling up their manufacturing capacity to several hundred kilometres of wire per year.

Many applications of high-temperature superconductors have been prototyped in recent years. These applications divide into two categories: wire based and film based. In both cases, wider issues involving cryogenics, the interface between the high-temperature superconductor and the ambient environment, so-called fringing fields and nonlinear scale-up issues have been addressed. Here we focus just on the wire-based applications.

HTS power cables

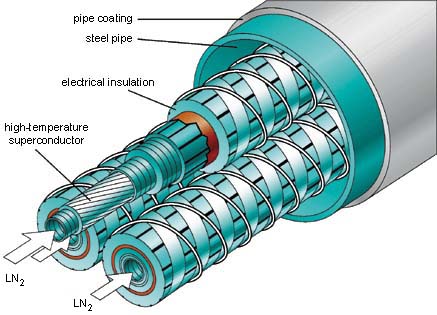

In most countries, the loss in distributing electrical power from power stations to consumers is at the 7-9% level, which is worth about £1.7 billion per year in the UK alone. This is a compelling motivation for superconducting cables, which – at least in a DC environment – could virtually eliminate such electrical losses. Although cooling losses would remain, these can be engineered to be small.

However, a more powerful motivation is that many of the cable conduits running into large cities and towns are already full. Any further growth in demand for power cables will encounter costly real-estate issues, such as the purchasing or leasing of new land corridors and the disruption caused during excavation. HTS cables offer a two- to tenfold increase in power capacity for the same cross-sectional area of cable. Thus, large cost savings may be achieved by “retro-fitting” HTS cables into existing conduits without the need to dig up streets.

A broad range of prototype HTS cables has already been implemented. All have a similar design comprising concentric sheaths of insulation, cooling ducts, shielding, dielectric and conductor, and are cooled to 70-77 K using liquid nitrogen, which is pumped through the central core (figure 4). Several commercial-scale HTS cables will be tested in fully operational environments starting this year, including a Pirelli-led project at Detroit Edison in Michigan. Pirelli manufactures cable from HTS wires made by American Superconductor Corporation, and has teamed up with the US Department of Energy (DOE) and the Electric Power Research Institute (EPRI) in California for the project. Pirelli also runs a number of laboratory demonstrations in Europe with American Superconductor, Electricité de France and ENEL – the Italian power research institute, and the former Siemens cable division, which was recently acquired by Pirelli.

In addition, HTS cables will be demonstrated by Southwire in Georgia, US, but these will not be connected to the electricity grid. The Southwire team includes Intermagnetics General Corporation (IGC), which manufactures the HTS wire, the Oak Ridge and Argonne National Labs, Southern California Edison, Georgia Transmission, Southern Company and also EURUS Technologies.

Meanwhile, the Tokyo Electric Power Company, the largest private electric utility in the world, has funded demonstrations of HTS cables at Sumitomo Electric and Furukawa Electric. Other active HTS-cable programmes are maintained by BICC in the UK, Nordic Superconductors in Denmark, Australian Superconductors Ltd, and Fujikura and Chubu Electric Power Company in Japan.

Detroit Edison’s 100 MV A cable is 120 m long and comprises three single-phase HTS cables rated at 24 kV. It replaces nine copper cables at a substation in Detroit and supplies sufficient power for 30 000 residential customers. And, impressively, the total HTS conductor weighs 70 times less than the copper cables it replaces.

Provided operational demonstrations such as this prove successful, fully commercial implementations can be expected within the next few years. A recent study predicts that HTS cables will account for 56% of the underground-transmission market within 10 years of the first commercial sale.

Transforming transformers

Another promising area for applications of superconductors is transformers. Although HTS transformers have the potential to be more efficient than their non-superconducting counterparts, several other benefits may be even more important. A large HTS system (>30 MV A) is expected to weigh about half as much as a conventional transformer and have a smaller “footprint”. Furthermore, high-temperature superconductors offer the opportunity to eliminate the oil that is used for cooling and dielectric purposes. This is an important consideration. Transformer oil may weigh in excess of 70 tonnes, requires cycling and filtering, and represents a major fire and contamination risk. These last factors are critical when transformers are housed in confined spaces, underground or by waterways. In contrast, liquid nitrogen has ideal dielectric properties and represents a significantly lower environmental and fire risk.

In many countries the maximum transformer size is limited by the weight load of the trucks, road bridges and cranes needed to transport it. Weight reductions therefore become highly desirable under such constraints.

Moreover, HTS transformers can incorporate fault-current limiters, which protect other components in the system if there is a short circuit. They also enable low-impedance designs, which offer many other important benefits, such as improved voltage regulation and increased substation capacity. The total world market for transformers exceeding 30 MV A is estimated to be $3 billion per year.

The efficiency of an HTS transformer is limited by the need for it to operate under AC conditions, and here the concept of lossless conduction fails. Dissipation occurs as magnetic flux is cycled in and out of the superconductor. In order to minimize AC losses, a completely different wire architecture is required compared with the DC wires discussed earlier.

AC superconducting wires again comprise of separate filaments, but these must be decoupled from each other using a high-resistance matrix and/or a resistive sheath. In addition, the filaments need to be twisted along the length of the conductor to reduce eddy currents between the filaments that contribute to electrical losses. Although low-loss AC superconductors are still in the early stages of development, significant progress has been made in many laboratories.

In spite of the infancy of the technology, an operational 630 kV A HTS transformer cooled using liquid nitrogen was installed in Zurich in March 1997. This was designed and constructed by Asea Brown Boveri using conventional DC wire from American Superconductor and was in operation for almost a year. And in May 1998 Waukesha Electric in Wisconsin, US, tested a 1 MV A single-phase transformer in conjunction with IGC, Oak Ridge, Rochester Gas & Electric and the Electric Power Research Institute. This was cryogenically cooled and energized to 11 000 V and 150 A. More recently, Asea Brown Boveri, American Superconductor and Electricité de France have teamed up in a four-year programme worth $15 million to develop AC wire for HTS transformers, and have initiated two new 10 MV A transformer projects in France and the US. The US project is in collaboration with the DOE, Southern California Edison and American Electric Power.

Motors and magnets shape up

According to industry reports, the total worldwide market for electric motors rated above 1000 horsepower (hp) is $1.3 billion per year. Moreover, such motors are estimated to use about 30% of all the electricity generated in the US. As with transformers, there are similar benefits associated with the conversion to HTS technology, which include reducing the size and losses by 50%, as well as improving stability during operation. A size reduction of this magnitude is a major benefit for certain applications, such as ship propulsion.

Currently, the only major programme in HTS motors is being undertaken by a long-standing partnership between American Superconductor and Reliance Electric, a subsidiary of Rockwell Automation. Following the success of a 286 hp prototype motor, the partners are due to complete the first commercial-scale HTS motor – a 1000 hp AC synchronous “air-core” motor. The cryo-cooled rotor contains four HTS coils, which allow higher magnetic fields than their conventional counterparts while eliminating the need for heavy iron cores (figure 5). Meanwhile, coils are currently being manufactured for a 5000 hp commercial prototype HTS motor due to be completed late in 2000, with the first sales expected the following year.

Based on the success of these earlier demonstrations, American Superconductor received a contract from the US Navy in June 1999 to design a 25 000 hp HTS ship-propulsion motor. To underscore their aggressive commitment to this technology, the company has recently created a new business unit focused on the design, development and manufacture of HTS motors and generators.

A range of demonstration HTS magnets has continued to be developed since HTS wire was first developed in the early 1990s. In March 1997 an HTS magnet was installed in the beamline of a carbon-dating van der Graaf accelerator at the Institute for Geological and Nuclear Sciences in Wellington, New Zealand, and has been operating ever since (figure 6). The magnet was built by a consortium of American Superconductor, Alphatech International based in Auckland and Industrial Research Ltd – a New Zealand government research institute. The Bi-2223 magnet is designed to operate at 50 K, and is cooled using a single-stage refrigerator. Although it only needs to develop a field of 0.74 T, the magnet has been in operation for nearly 3 years. This demonstration of long-term reliability, albeit in a moderately demanding application, is an important achievement for the wider commercialization of HTS technology in general – it was probably the first large-scale fully operational application of HTS technology in the world.

More impressive results from demonstration magnets have been reported. In July 1998 the Naval Research Laboratory in the US successfully tested an HTS electromagnet producing a record HTS magnetic field of 7.25 T using coils made by American Superconductor. And more recently Hitachi, together with the National Research Institute for Metals and the Tsukuba Magnet Laboratory in Japan, demonstrated a 23.4 T superconducting magnet with a 13 mm bore. This consisted of an 18 T low-temperature superconducting magnet with two Bi-2212 booster coils operating at 4.2 K, and is almost at the 23.5 T threshold needed for nuclear-magnetic-resonance applications at 1 GHz.

A number of other companies have similar ambitions, and 21 T coils made by IGC and also by Oxford Superconducting Technology have been demonstrated at the National High Magnetic Field Lab in Florida. In another development in late 1998, Oxford Magnet Technology and Siemens Corporate Technology built a prototype magnetic-resonance-imaging body scanner with two coils made from Bi-2223 wires, which were manufactured separately by Nordic Superconductor Technologies and by Vacuum-Schmelze.

Superconductors go from strength to strength

Other HTS technologies are also making their mark, most notably fault-current limiters and low-thermal-conductivity current leads to reduce heat leaks into the cryo-environment of low-temperature superconducting high-field magnets. Some 1600 of these current leads, each carrying 13 000 A, will be deployed on the low-temperature superconducting magnets in the Large Hadron Collider particle accelerator at CERN in Geneva. In parallel with these wire and bulk applications, a spectrum of thin-film applications for microwave antennas, filters and superconducting quantum interference devices has also emerged.

It is clear from the broad base of applications and their proximity to commercial-scale demonstrations that HTS technologies are on the threshold of the promised superconductor revolution. As manufacturers scale up production, prices will inevitably be driven down and the commercial viability will be further enhanced. Add to this the voracious appetite of the information-technology industry for faster communication, larger memory capacity and faster processing power, and it is clear that the market pull for electronic HTS technologies will grow dramatically in the next few decades. Already superconductivity appears to have established a secure beachhead on the technological and commercial landscape of the 21st century. Based on these considerations, a consortium of European companies has recently estimated that the total world market in superconducting products will reach £22 billion by 2020.

Finally, the recent appearance of new ruthenate-cuprate HTS materials, which exhibit ferromagnetism and superconductivity at the same time, overturns a long-held belief that these properties are generally incompatible. This serves to remind us again that novel materials with strange and unexpected properties will continue to appear, and our technology horizons will continue to expand.