It's a question that plays on the minds of millions of people around the world: when is the current rise in house prices finally going to cease? According to new calculations by a theoretical physicist in France, the answer is "soon". Based on an a analysis of historical house prices on the West Coast of the US, Bertrand Roehner of the University of Paris VII has concluded that prices have reached record levels and could soon be heading for a slump. And although the data come from just one region, property prices in many other developed countries may follow the same pattern (physics/0605133).

House prices in the big cities of most developed nations, notably with the exception of Japan, have been rising steadily over the last few years. Although the current price increases have the same magnitude as previous rises (typically an increase of between 80 and 100%), the present price peak seems to be lasting for longer than usual. To understand why and to make predictions for the future, Roehner fitted models to quarterly average house prices on the West Coast of the US over the last 40 years.

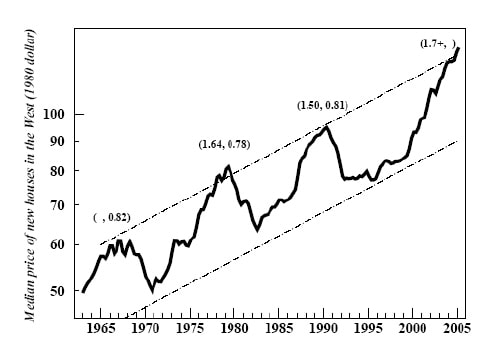

Roehner identified four rapid surges in house prices during this period, each of which lasted about ten years (figure 1). He then calculated two numbers for each period: the amplitude of a peak (defined by the ratio of highest price to initial price) and the magnitude of the fall in prices (defined by the ratio of the lowest price to the peak price). The results show that the current peak is still in its up-going phase and will have an amplitude larger than 1.7, which is higher than any previous amplitude. This figure is generally less than 3 because house prices are limited by how much people earn.

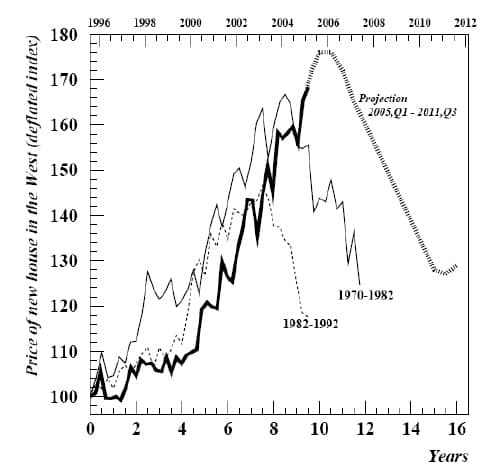

The model can also predict how house prices might evolve between now and 2011, and shows that the high prices will slowly start to come down at the same rate as they went up (figure 2). This decrease, which will take about six or seven years, is characterized by exponential price falls with rates of about -6% per year, and will start in major cities such as San Francisco and Los Angeles with smaller cities following suit. These predictions might also hold true for other big cities, like London, Madrid, Paris or New York. Indeed, in Melbourne and Sydney the descent has already started.

Roehner says the current period is somewhat different to previous years because there is an inflated demand for property — mainly from investors and high-income buyers — that was not so important before. Moreover, investment funds (including pension and hedge funds) and the stock market are more closely associated with real estate than in previous years. Speculation has also boosted house prices to sometimes unreasonable levels.

However, Roehner also stresses the limits of his and other such models: “Consider the London housing market,” he says. “A year ago everybody (including myself) was convinced that the turning point had been reached and that prices would decline. In fact, over the last 12 months real estate prices in London have increased by 8%. What happened? As explained in a recent article published in the Economist, Gordon Brown [UK Chancellor of the Exchequer] has offered a governmental guarantee to banks and other lending institutions and devoted about $2 billion in subsidies to encourage buyers. Naturally, no model can take such events into account in advance.”