Serial entrepreneur Tim Harper shares lessons from 20 years of good, bad and (occasionally) ugly experiences of starting and running nanotech businesses

Back in 2000, the field of nanotechnology was just starting to shift from something that involved tiny robots and molecular gearwheels to real, tangible science with potential applications. In October that year, I organized the first Trends in Nanotechnology (TNT) conference in Toledo, Spain, and as with all conferences, the real work happened in the hotel bar.

The atmosphere inside the Hotel Maria Cristina was febrile. The US National Science Foundation was predicting a trillion-dollar nanotechnology market by 2015. Huge national and European nanotechnology projects were taking shape, and there we were, the cream of the nanoscience community, poised and ready to change the world. New sensors, new ways of delivering drugs, molecular memories – even carbon nanotube-based space elevators to the stars – all seemed within reach. Surely, within a decade, we’d have changed all manufacturing from “top down” to “bottom up”, solving the interlinked problems of clean energy, climate change and human happiness at a stroke.

Ten years later, when I found myself having a similar discussion about graphene, I realized that the nanoscience and materials community could do with a few basic rules to avoid getting overexcited and wasting both time and money.

Rule 1: forget about the science

When you’re deeply involved in a particular field or technology, it is hard to imagine that there could be alternative views about its usefulness. However, before you can commercialize anything, you have to find someone who wants it. Your investors or funders (if any) need to know who will buy products based on your technology, what they will buy and why they will buy it. And the biggest problem you face when you step outside the laboratory door into the real world is…indifference.

Let’s face it. Most things, from medical imaging systems to communications devices, work pretty well these days. I gave up the annual iPhone upgrades years ago because the improvements in technology weren’t compelling enough to justify the hassle. New technologies have to be 10 times faster, 10 times cheaper and come with a highly scalable business model before they get much attention.

To avoid having doors repeatedly slammed in your face, start with the market, not the science. Find an unmet need, then quantify it by talking to people who have that need

A similar situation exists in the composites industry. While there are advantages to be gained from adding carbon nanotubes or graphene to a product, carbon fibre also works in many applications, is well understood and has a robust supply chain. Why would, say, Airbus base major business decisions on an immature technology from a company that might cease to exist long before its material makes it through the lengthy aerospace qualification process?

To avoid having doors repeatedly slammed in your face, start with the market, not the science. Find an unmet need, then quantify it by talking to people who have that need. If the answer to their problem is your technology, then go ahead. If it isn’t, then you’ll spend a lot of time battling indifference.

Rule 2: don’t assume anything

When I worked with the Massachusetts Institute of Technology (MIT) on the M+Vision IDEA3 programme, we offered a structured scheme to help our students find unmet needs. Often, the students would start with a woolly concept such as “better detection of cancer”, to which we’d ask questions like “What sort of cancer? At what stage? Using imaging or biopsies or genetics or something else?” Once we had a focus, we would then start talking to clinicians and radiographers to find out what issues they had. In many cases, the response was that current technology was okay, with room for incremental improvements but no urgent demand for change.

The lesson here is that if you don’t properly research your end users or customers, you may end up producing a solution to a problem that doesn’t exist. But you probably won’t even get that far. Any business plan needs to show investors how they will get their money back. It doesn’t matter whether you are selling widgets or a service or licensing the technology: before you can make any predictions, you need to understand the market.

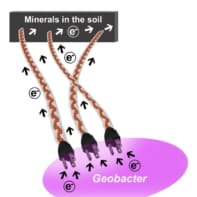

Here’s an example. When I was putting together my company G2O Water Technologies, which makes graphene-based water filtration membranes, I spent a lot of time talking to people in the water industry. I needed to understand how membranes are used, what their limitations are, and how often they are replaced. I spoke with water research institutes and membrane experts, and I attended multiple talks and conferences until I was sure that our product fulfilled an unmet need in the water industry. Only when I fully understood the market did it become possible to make sense of the myriad (and often contradictory) market research reports that purported to give me definitive numbers about an industry.

This information-gathering stage is also when you will often find out about some hitherto unknown regulatory issue surrounding the use of new materials in certain environments – with the result that all your revenue forecasts move a couple of years to the right on your spreadsheet. Once you’ve completed this exercise, though, you should have a good idea of how to answer questions about who will buy your widget, how much will they pay, and when.

Rule 3: build a team

I spent six years at the European Space Agency, mostly working on electron microscopy, surface analysis and atomic force microscopy for failure analysis, and I’ll never forget the feeling I had when I left to set up my first business, Cientifica. After spending months designing a set of wings that would, I hoped, enable me to soar like an eagle, I was about to test them by jumping off a clifftop. I didn’t hit the ground with a big splat, but I came pretty close, and on the way down I had to learn all sorts of things: cash flow, margins, sales channels and (not least) the Kafkaesque bureaucracy that was, at the time, involved in filing social security and tax returns in Spain.

But perhaps the most valuable lesson I learned is the importance of working out what you are good at, where you need help, and then building a team to fill the gaps. For my second start-up, NanoSight, I brought in a chair who knew his way around the financial world and a managing director who could keep on top of the day-to-day issues – leaving me free to develop our technology to match our vision.

It is also important to build a good external team. I often recruit a scientific advisory board – half a dozen well-connected, respected and highly knowledgeable experts – and meet with them several times a year to check whether we are still on the right track. When you are 100% focused on building and promoting a business it is all too easy to start believing your own marketing story. Having to justify your strategy to independent people helps keep your feet on the ground. It also keeps you abreast of technology or competitive developments that you may have missed.

A note of caution, though: executive teams, like rock bands, do break up. Senior-level disagreements within a team are very common, and once money (or lack of money) is involved, best friends and colleagues can become bitter enemies. There’s always someone on the team who thinks they could do a better job of running the show.

Rule 4: don’t suffer fools

If you’ve followed rules one to three you will be confident that you have something that someone wants, as well as the team to take it to market. That’s when the hard work begins. There will always be people who will tell you it can’t be done. Sometimes the reason is a simple fear of change or corporate inertia; maybe you came up with a better idea than the people paid to come up with ideas. Other times it’s a lack of understanding of the technology. Occasionally, it might just be pure, bloody-minded stupidity.

The worst mistake I have made by far was to continue trying to salvage a failing business when everything pointed to closing it down. It was my business, my life, and what everyone knew me for

When I started testing the first nanoparticle imaging systems for NanoSight, several learned professors told me that what we were doing was impossible. Even after I ran a demo for them and explained the distinction between imaging and detecting the light scattered from a particle, some people were adamant that it was impossible to use optical methods to detect anything smaller than the wavelength of the laser we used.

The world is full of people who are so certain of their own beliefs that they will never change their minds, however wrong they may be. Don’t take it personally. Move on.

Rule 5: choose the right funder

How much is a start-up worth? I take the Adam Smith view that it is worth whatever someone is willing to pay for it, but no-one parts with money willingly – especially for a risky early-stage business. There are, however, some warning signs. Once, a potential investor offered me €100,000 for 90% of the business and received a lecture on idiotic time-wasting in return. Many other “investors” don’t actually have any money. Instead, they are looking for interesting deals that they can hawk around to people who do in the hope of taking a cut of the transaction. (California and China seem to be particularly good locations for people trying to squeeze themselves between you and a funder.)

In most cases, no deal is better than a bad deal. If your investors don’t believe in your team and your company’s vision, then it is going to be a long hard slog. Instead of building value into the business, you will end up having board meetings that focus on whether the CEO really needed an extra shot of espresso in their latte before the 6 a.m. Ryanair flight. However, there are times when you just can’t wait. In that case, make sure you go in with your eyes open, get your own legal advice and try to avoid joining the unfortunate group of founders whose stake gets diluted to almost zero by subsequent investors.

The best funding sources bring more than just money to the table. Expertise, contacts and access to markets can all add value. Good investors may help you flesh out your board of directors or introduce you to other companies in their portfolios. That may present opportunities. Investors like the idea of their portfolio companies working together to add even more value (and create a potential exit through acquisitions).

Rule 6: mind your ego

The life of an entrepreneur is a tough one. For every Mark Zuckerberg who hits the bullseye at the first attempt there are millions who fail, and that’s perfectly okay. I’ve had great businesses and terrible businesses. Sometimes it has been my fault that they failed, sometimes it was because of circumstances no-one could predict, but I’ve learned from them all. Most importantly, I’ve learned not to worry too much about what anyone else thinks. For every person who takes the plunge and tries to create a business, there will be hundreds waiting to tell you how you ought to have done it. Ignore the armchair entrepreneurs.

A year down the road, it may become apparent that the opportunity you are pursuing is not the right one, or that there is a more easily accessible prize. Sometimes a rethink is necessary. One medical diagnostics technology I helped develop ended up being used for water-quality testing. Of course, I had to go back to our investors and tell them that our game-changing diagnostics technology was actually being used in sewage treatment, but in a world where nine out of 10 start-ups fail completely, any return is better than nothing.

It’s embarrassing, at first, to have to admit that you didn’t get it right, but the biggest mistake is to be afraid to fail. The worst mistake I have made by far was to continue trying to salvage a failing business when everything pointed to closing it down. It was my business, my life and what everyone knew me for. Leaving it was tough. But in the end, a clean bail-out is always preferable to a messy failure; it’s quicker and you don’t get sued. When the time comes, bite the bullet and jump.

Rule 7: have fun

The past 25 years of entrepreneurship have produced some incredible highs and some terrible lows, but if I had the chance to do it all again, I’d jump at it. Success isn’t all about money and there’s nothing quite like the feeling of seeing an opportunity you identified, nurtured and grew become a success. And while there have been times when I worked 18-hour days and still struggled to pay the bills, the pain was more than balanced by having no office, no commute, no boss and complete responsibility for my own destiny.

- Enjoy the rest of the 2019 Physics World Focus on Nanotechnology & Nanomaterials in our digital magazine or via the Physics World app for any iOS or Android smartphone or tablet.