With electric cars set to enter the mainstream over the next few years, Susan Curtis investigates the new charging solutions that will be needed to power what are effectively large batteries on wheels

Ever since Henry Ford launched the Model T in 1908 as the first truly mass-market car, the internal combustion engine has ruled the roads. The problem is that cars, vans and lorries powered by petrol and diesel have simply become too successful. Transport now accounts for almost a third of all greenhouse-gas emissions across Europe, some 90% of which is spewed out by road traffic. And the health risks posed by the particulates emitted by fossil-fuel engines have prompted many cities to ban or restrict the worst offenders from central districts.

It’s no surprise, then, that the future looks electric. Prices are falling, batteries are improving, and more people are opting to buy plug-in hybrid or fully electric vehicles for the first time. The International Energy Association (IEA) reported a 63% increase in the global fleet of electric cars in 2018, while in the UK battery-powered models accounted for a record-breaking 13% of all new car sales in March this year – even though the overall market for new cars shrunk due to the coronavirus pandemic.

Indeed, current projections suggest that savvy buyers will make a large-scale shift to electric vehicles within the next five years. The initial outlay may still be higher, but more affordable models are now reaching the market and government incentives can often bring down the price differential. Electric cars are also significantly cheaper to run: the cost of electricity is about a third that of fossil fuels to travel the same distance, while fewer moving parts in all-electric models can reduce maintenance bills by up to 60%. Throw in the reduced resale value for gas guzzlers, more than a dozen countries having already set dates for when they will ban the sales of new petrol and diesel cars, and the smart money will go electric.

Some countries are already ahead of the curve. Norway, for example, offers generous tax breaks that have boosted adoption rates to 60% of new car sales, with a further 15% for plug-in hybrids. China, which has also made electric transport a national priority, now accounts for half of the world’s sales of battery-powered vehicles. Meanwhile, 13 major economies, including the UK, Japan and Germany, have pledged to increase the market share for plug-in models to 30% of all new registrations by 2030. If that happens, the IEA predicts that more than 250 million electric cars will be on the road by 2030, around 15% of the global fleet, with sales reaching 44 million vehicles per year.

Charging anxiety

But consumers convinced by the economics may still be worried about the practicalities of owning an electric car – specifically whether they will be able to charge their vehicle when and where they need to. While the latest models promise driving distances of up to 400 km on a single charge, numerous surveys by motoring organizations and policy advisers cite this “charging anxiety” as one of the biggest barriers for drivers thinking of switching. “Charging anxiety is a realistic concern for many drivers,” admits Olly Frankland of Regen, an independent energy consultancy based in the UK. “But the charging solutions are out there, and the anxiety quickly dissipates when consumers become familiar with owning and driving an electric car.”

Charging anxiety is a realistic concern for many drivers. But the charging solutions are out there, and the anxiety quickly dissipates when consumers become familiar with owning and driving an electric car

Most early adopters plug their car into a home charging point when they return from work in the early evening, which is easier than going to a petrol station. But this isn’t a sustainable approach for long-term mass-market adoption, since the energy network would become overloaded if everyone charged their cars at the same time. Home-based charging is also not viable for drivers without a dedicated parking space, and public charging points do not yet provide a convenient and reliable alternative to filling up at the pump.

The good news is that many of those problems are now being addressed. The UK’s National Grid, for example, has already drawn up plans for meeting the increased electricity demand as part of its Future Energy Scenarios programme, which has developed four different models of energy usage until 2050. Two of these projections assume the ambitious targets mapped out in the UK’s Road to Zero strategy, which says that 50−70% of new car sales will be plug-in hybrid or fully electric by 2030, with zero-emission vehicles becoming the norm by 2050. Although the overall energy consumed by road traffic would fall by as much as 70% in that scenario, the transport sector’s demand for electricity would rise from almost nothing today to around 90 TWh by 2050.

That extra demand on its own is not a huge problem: total electricity usage in the UK currently runs at around 1000 TWh per year, and the National Grid predicts a decline in overall energy demand over the next 30 years. More tricky will be managing the fluctuations in usage, with one of the models suggesting that widespread adoption of electric vehicles could boost peak demand from less than 60 GW at the moment to more than 80 GW in 2050.

A particular pressure point will be the local substations that supply low-voltage power to residential districts: one analysis by Regen suggests that households with an electric vehicle could use 40−50% more energy than the current average. The latest generation of domestic chargers delivers 7 kW of power – about the same as an electric shower – but could potentially be connected to the mains for several hours. “These are large batteries on wheels, and they need lots of electricity,” says Myriam Neaimeh of Newcastle University and the Alan Turing Institute – the UK’s national centre for data science and artificial intelligence – in London. “That demand needs to be managed to minimize how much we spend on upgrading our electricity networks.”

Various strategies can flatten the fluctuations, such as tiered tariffs that incentivize drivers to charge up when electricity is cheap and plentiful. Smart chargers are already available to allow drivers to decide when to top up their battery, with more intelligent systems making it possible to automate charging to use cheaper electricity or more intermittent sources of renewable energy. “Just as consumers look at the price of petrol, people choose to charge their car when electricity is the cheapest,” says Frankland.

That view was backed up by a large-scale trial of smart-charging solutions that ran from 2016 to 2019 in part of the UK. The Electric Nation project, hosted by Western Power Distribution and led by EA Technology, recorded the charging behaviour of 700 drivers split into three groups. Two groups were able to charge whenever they wanted but had no information about the cost of electricity to guide them – resulting in them tending to charge their cars when they got home in the early evening. The third group, however, had access to costing information and smart chargers. “Even though there was a priority option for anyone who needed a full charge for the next day, most people in this group were happy to use smart chargers to manage when and how much they recharged their batteries,” comments Frankland. That modified charging behaviour led to a more gradual rise in energy demand, which at all times remained within the capacity of the local electricity network.

Some capacity problems may still emerge in areas where lots of people choose to buy an electric vehicle, but the data from these smart chargers would enable network companies to pinpoint the precise areas that need network reinforcement. “Any upgrades of the electricity network will ultimately be paid for by customers in their energy bills, so the best approach is to manage the demand and target the investment in the right places,” says Neaimeh.

Vehicle to grid

Further in the future, there is even potential for electric-vehicle batteries to provide a distributed energy-storage system that would help electricity providers to manage periods of high demand or surplus supply. This so-called vehicle-to-grid (V2G) technology exploits bi-directional chargers and automated control systems to store energy in car batteries when power is plentiful, and then release it back into the electricity network at times of peak demand.

Such flexible grid services could benefit businesses that operate fleets of electric vehicles, allowing them to cut their energy bills or even make extra income by providing grid services. For individual drivers, meanwhile, an electric car plugged into the mains supply could be used to store energy when electricity is cheap, and then provide power to the home when prices are higher. “V2G should help customers to reduce their energy bills,” comments Neaimeh. “We want the technology to support the grid while reducing the total cost of ownership of the car.”

One of the largest initiatives to test the viability of this V2G approach is the e4Future project, led by Nissan, in which up to 300 V2G chargers are being deployed with commercial fleet operators. “For the first time, this project is bringing together two big players – the energy companies and the automotive industry – who will need to work together if we are to decarbonize our power and transport sector,” says Neaimeh, one of the lead academics involved in the project.

According to the National Grid, the energy that could be provided by such V2G technologies will be part of a more general trend towards more localized energy sources, such as small wind turbines and solar-panel installations, which it believes will account for around 22% of the overall energy mix by 2050. Indeed, local authorities and commercial operators are already installing renewable-energy sources in car parks to generate energy for local buildings and provide power to electric vehicles. In Exeter, for example, solar canopies have been built on the top deck of two multistorey car parks in the city centre, a successful trial that has paved the way for a £1.3m project to install charge points powered by renewable energy across Devon’s towns and cities.

Fast charging

Major energy companies and specialist charge-point operators are rushing to install public charging stations on garage forecourts, motorway service stations and other public places. The UK already has 16 major charging networks and many more smaller or regional operators, which together provide more than 31,000 connection points. Most of these provide fast (generally accepted to be 7–22 kW) or rapid (25–99 kW) charging, with a few offering ultra-rapid services that can provide a full charge within about 20 minutes. “It is a very competitive market and lots of operators have installed as many charge points as they could in the best locations,” says Frankland.

But these rapid charge points are not necessarily the best solution for consumers. The electricity they provide is expensive, while reliability has been poor compared with other major infrastructure – at least in the UK. Each operator also runs different payment and membership schemes, which has made it difficult for drivers to access different networks and charging stations. “The public charging infrastructure should not be locked into a specific equipment or network provider, either commercially or technically,” a spokesperson for the Brussels-based trade association ChargeUp Europe told Physics World. “Open protocols should become the norm so that any operator and hardware meeting these minimum standards can compete on the market.”

More regulation is helping: operators must now offer the option of pay-as-you-go charging with a standard card payment, while roaming agreements are emerging in mainland Europe and the UK that exploit open protocols to enable seamless access and billing between providers. “Bringing together all the different apps and systems is quite challenging, but some of the larger charge-point operators are now starting to be a bit more consistent,” says Frankland.

Slow and smart charging

Given the current confusion around the plethora of public networks, it’s little wonder that most drivers prefer to charge their car at home. Slow charging at up to 7 kW benefits power-system management, and helps to maintain the long-term performance of the battery. “Superfast chargers are useful along travel corridors and in urban filling stations to allow drivers to quickly top up their batteries when they need to,” says Neaimeh. “But most charging demand should be met by installing low-power smart chargers where electric cars are parked routinely for long periods of time – at home and at work – to spread the demand for electricity and to make the most of renewable energy.”

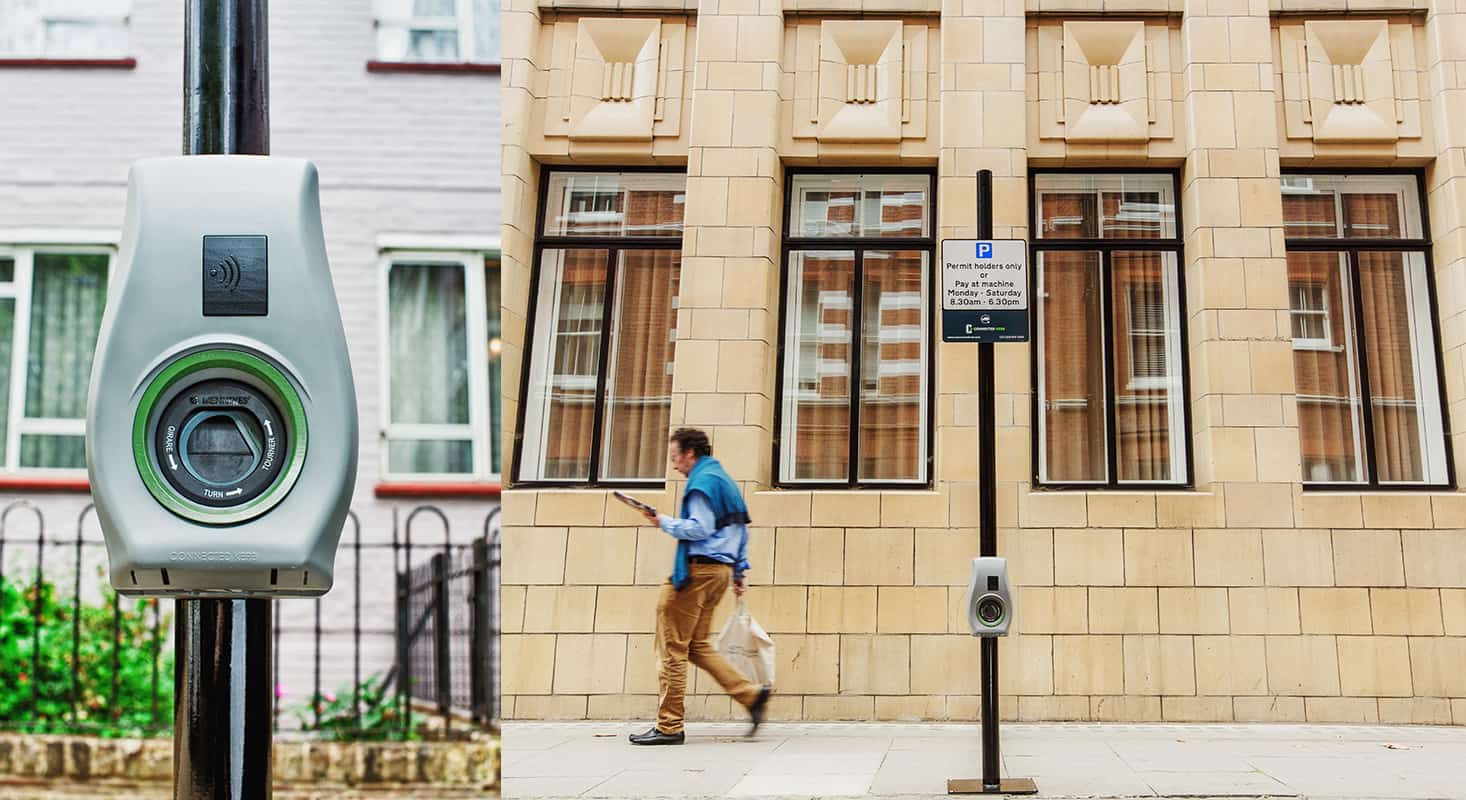

Still, slow charging at home remains a challenge for drivers who do not have their own drive or garage – most notably the millions of city dwellers who stand to benefit most from switching to electric. According to Chris Pateman-Jones, chief executive of London-based charge-point operator Connected Kerb, around 34% of UK drivers park their car on the street while a further 28% have a parking space with no connection to a domestic power supply. “Our research indicates that most drivers want to top up in a regular, habitual way,” he says, “but that’s just not possible for the vast majority of people who don’t have easy access to a residential charging point.”

Some operators have addressed this problem by installing charging points in street lamps, which are already connected to the electricity network. With a power rating of just 1–2 kW, however, it can take an hour to get enough power to drive 30 km, while trailing cables across the pavement is a clear trip hazard that many local authorities are keen to avoid.

Connected Kerb has therefore instead designed a series of dedicated on-street solutions that deliver slow charging at 7 kW. “Our approach is to separate the socket from the charger,” explains Pateman-Jones. “The socket sits above the ground, and is really small and discreet. The charger itself is installed below ground, which improves reliability because it is secure and protected.”

The beauty of this solution, says Pateman-Jones, is that it can be deployed at scale. “Rather than just installing two or three charging points in a neighbourhood, our technology can connect a whole street to the electricity network,” he says. “We exploit existing street furniture, such as parking posts and street bollards, which allows large numbers to be installed without ruining the visual look of the street. And wherever possible we put our kit in the ground when telecoms and utility companies are already digging up the roads.”

All the underground nodes are connected to the fibre network, making it possible to support smart-charging technologies as well as ancillary services, such as WiFi, environmental monitoring and potentially 5G. The modular design also ensures that the installed infrastructure is future-proof, with the underground chargers able to support the widely anticipated transition to wireless charging (see box below).

However, Pateman-Jones concedes that it will be a huge challenge to provide enough charging points in all residential areas. “Our estimates suggest that 62% of the driving population can’t charge their car at home,” he says. “Providing a charging point for one in four of those people would need 10,000 charging points to be installed every month for the next 15 years. The numbers are massive.”

For that reason Frankland believes that more diverse charging solutions will be needed in dense urban districts. “There could well be a move towards local charging hubs that would offer low-cost charging at 7–22 kW for a specific neighbourhood,” he says. “That approach could be easier to deploy in some localities, and would still allow residents to drip-charge their car for a few hours or overnight.”

But he is convinced that slow and smart charging will be the preferred option for many years to come. “You don’t need ultra-rapid chargers everywhere, and you don’t want them everywhere, because the cost of the electricity is higher and they put more strain on the local electricity network,” he says.

Instead, Frankland believes our charging behaviour will evolve to fit around our lifestyles. Fast forward to 2030, and we could well see lots of charging points in the workplace complemented by low-cost charging in supermarkets, hotels and other regularly visited leisure and retail sites. “You will be able to integrate your charging into your daily life,” Frankland predicts. “Rather than going to a petrol station every so often to fill up the tank, it will become second nature to charge while you park.”

A wireless future

Trailing cables are one of the less attractive aspects of owning an electric car, but wireless charging technologies change all that. The most promising for urban drivers is induction charging, which transfers energy from a charging pad on the road to a receiver inside the car. “Induction charging is a fantastic technology that provides neater, cleaner charging for all users,” says Nick Dobie, one of the founders of London-based Connected Kerb. “It’s currently an expensive option, and not many vehicles are fitted with the right receivers, but it will change the face of charging over the next decade.”

Connected Kerb has already started to trial induction charging in specific use cases, in particular for drivers with disabilities that make it difficult for them to grapple with bulky cables. The company is also targeting taxi ranks – since taxi drivers would no longer need to take time out of their working day to top up at a rapid charging point – and shared vehicle schemes that typically have a dedicated parking bay.

Meanwhile, some companies are investing in technology that can exploit wireless charging to top up a car battery while it is being driven. Qualcomm, for example, has teamed up with Renault to demonstrate this dynamic charging technology along a 100 m test track in France, showing that an electric van can charge at up to 20 kW while travelling at speeds of 110 km/h. The Swedish eRoadArlanda project has built 2 km of electric road that provides on-the-go charging at 200 kW – enough to power the battery of an 18-tonne truck.

The team behind eRoadArlanda believes that just 26,000 km of Sweden’s main roads would need to be electrified to provide an effective en route charging solution, which could be reduced by a factor of five if the power could be increased to 800 kW. “Electric roads can reduce the emissions and noise from existing road transport,” says project manager Sofia Lundberg. “The more traffic there is on the road, the greater the social and economic benefit.”