With launch costs plummeting fast, James McKenzie examines the huge commercial potential of the space sector

Go on, admit it. Who secretly wouldn’t want to go into space? The lure of leaving our earthly shackles has certainly proved powerful for Amazon founder Jeff Bezos and Star Trek actor William Shatner, both of whom flew into space last year on board a Blue Origin craft. Richard Branson also blasted off on a Virgin Galactic test flight in 2021. But space tourism could soon be open to more than just billionaires. In fact, the market is expected to grow from $886m in 2020 to $2.5bn in 2027, according to the firm Marketwatch.

The main reason for the growth lies in reusable space craft, which slash launch costs. Back in 1981, when NASA unveiled its space shuttle, it cost about $85,000 per kilogram to put an object into space. By 2020, SpaceX’s Falcon Heavy vehicle had broken the $1,000/kg barrier. Growing competition helps too. Other firms in the commercial and space-tourism sector now include Space Adventures, EADS Astrium, Armadillo Aerospace, Excalibur Almaz, Space Island Group, Boeing and Zero 2 Infinity.

The main reason for the growth in space tourism lies in reusable space craft, which slash launch costs.

Here in the UK there are already five “space ports”, including one near Newquay in Cornwall, just off the Atlantic coast. Spaceport Cornwall expects to host regular Virgin Orbit launches from early 2022 and hopes to be the UK’s only “horizontal spaceport” – meaning that rocket-carrying planes can both take off and land. So far Virgin has sold about 100 seats at $450,000 apiece and has some 700 reservations.

Give me space

But space tourism is just a tiny part of the wider commercial space market, which Morgan Stanley estimates could generate revenue of $1 trillion or more by 2040. The most significant short- and medium-term opportunities, it said, are likely to come from satellites offering broadband Internet access connecting the most remote parts of the planet. Indeed, the global satellite internet market, which was worth $2.93bn in 2020, is projected to rise to $18.59bn by 2030.

The asteroid trillionaires

Established providers, such HughesNet and Viasat, currently use a few big high-performance satellites in large orbits. In Viasat’s case, it is launching three new 6.4 tonne satellites into geostationary equatorial orbit 36,000 km above the Earth.

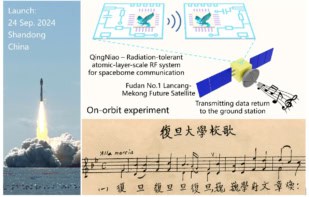

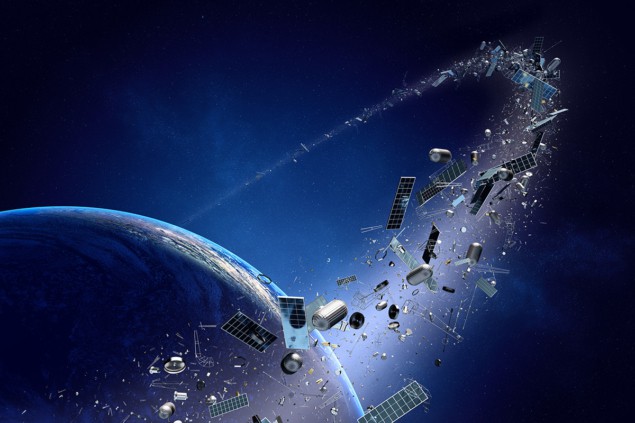

Delivering a connectivity of tens of megabits, the satellites will give users Internet access for as little as $100 per month. However, other firms – notably SpaceX with its Starlink system – are focusing instead on putting lots of smaller, cheaper satellites into space. Weighing just 260 kg each, they will fly in very-low Earth orbit at heights of roughly 550 km, which means that atmospheric drag will pull them down within a few years so they don’t end up as yet more space junk.

The wider commercial space market could generate revenue of $1 trillion or more by 2040.

Starlink will have a very low “latency” – the time between starting to do something on the Internet and receiving a response – of just 45 ms. That’ll make it great for calling, gaming and streaming, with Starlink’s latency not far off fixed broadband (14 ms) and far better than Viasat (630 ms) and HughestNet (724 ms). Starlink will also be faster, with some users reporting 400 MB download speeds already.

Most importantly, though, Starlink may be cheaper, partly because the company can launch up to 60 of its satellites at a time. SpaceX has already launched 1584 Starlink satellites to provide a near-global service and the firm has approval from US authorities to launch 12,000, with the eventual goal being 30,000. OneWeb – another US competitor – has so far launched 358 and will achieve global coverage using 648 satellites by the end of 2022.

Doing business in space

I also see a lot of mileage with CubeSats – shoebox-sized craft initially invented as an educational tool for students. Quicker and cheaper to build than conventional satellites, there are already thousands of CubeSats orbiting the Earth. Sent up by universities, governments and start-ups, they do everything from monitoring deforestation to tracking radio-tagged endangered animals. They typically last for no more than five years, burning up when done. The Japanese firm Astroscale has even used them in testing for capturing space junk – releasing and catching a CubeSat using a magnetic system.

I see a lot of mileage with CubeSats – shoebox-sized craft initially invented as an educational tool for students.

Of course, there is an environmental cost to space, with most launches relying on fossil fuels. However, great strides are being made. Bezos’s Blue Origin’s rockets are already powered by a mix of liquid hydrogen and liquid oxygen, which emit little or no carbon dioxide when burned. The Scottish firm Orbex, meanwhile, is developing a reusable orbital rocket called Prime. Powered by ultra-low-carbon biofuel, it will have 86% fewer emissions than a fossil-fuel rocket. Orbex is also committing to offsetting all emissions from the rocket and ground operations, ensuring every launch is carbon neutral. The craft is due to blast off for the first time from the north of Scotland later this year.

Another interesting approach is being taken by SpinLaunch, a Californian firm that is developing a vacuum-sealed centrifuge to spin a rocket and then hurl it to space. Last November, it carried out the first successful test launch of its proof-of-concept system, which it says ultimately would need a quarter of the fuel of conventional craft and cost only a tenth of the price of a standard rocket launch.

Bright future

One of the problems with the space sector is the lack of clear agreement between nations about who can do what – and to ensure there is actually some space in space. We urgently need to develop a sensible, global framework for managing space traffic and deal with the problem of space junk. Given that even a tiny bit of debris could knock out an entire satellite, who would want to launch a craft if the payload were likely to be destroyed?

That problem aside, it’s certainly a boom time for the space sector. The UK, for example, recently celebrated the 100th start-up firm to join the European Space Agency’s UK business-incubation centre, which claims to be the world’s largest space-innovation network for start-ups. And while Elon Musk’s promise of settlements on Mars by 2050 might seem a tad optimistic, don’t underestimate the commercial potential of space closer to home.

• For much more on the commerical opportunities for businesses in space, check out this special Physics World Collection.